Thinking Like a Surfer: Following the Liquidity Tide

Investors have a lot to learn from surfers.

Surfers know that they cannot change the conditions presented to them. They have no sway over the tides, the winds, the weather and the season, which all can cause large variations in waves.

Instead of fighting their environment, surfers change their approach and the tools they use to make the most of these conditions.

Taking the tides, winds, weather and season into account, surfers can then decide where to surf, when to surf, whether to surf the break left or right, what kind of board to use and if they have the ability to safely surf the wave.

Take the infamous Banzai Pipeline on the North Shore of Oahu. The break is best October-March, with a swell out of the northwest, with light winds and medium tide, on a shortboard or gun and only safely accessible to highly skilled surfers. Any other combination can be lackluster and even dangerous.

So instead of fighting or forcing their will on conditions, surfers flow with and adapt to their environment to get the best results.

To thrive in today’s market environment, we should think like surfers: the market environment is changing, so what worked well in one set of conditions may not work as well in the conditions emerging today.

Perfect, Glassy Conditions

The dream day for many surfers is glassy conditions, where winds are so light and un-disturbing that the water looks smooth as a mirror.

For the last eighteen months we have been in an extraordinarily supportive environment for risk assets, equivalent to a perfect day of glassy waves.

Liquidity has been abundant and cheap, while support for the economy has kept demand robust and surprising to the upside.

To put this in market data terms, highly accommodative policy has allowed financial conditions to remain near all-time lows (Chart 1), even while overall demand has surged back to now being above trend (Chart 2).

This combination of ample liquidity and strong demand has enabled valuations to remain historically elevated as earnings rise rapidly, explaining the powerful market returns in 2021: strong earnings growth has only partially been offset by valuation compression (Chart 3).

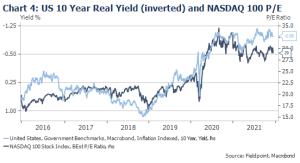

This environment has also been stellar for Growth stocks, which have seen powerful valuation expansion as money has become increasingly cheap with negative real yields (Chart 4).

Further, this environment of strong returns, strong growth and ample liquidity has also fostered a market mood that is ravenous for risk and embracing of speculation. This speculation has rewarded participants with supernormal returns in the riskiest corners of the market.

But as we look into 2022, we are starting to see signs that the winds are picking up and the tides are changing.

Liquidity Tides Impact Speculation First

Early in 2021 we thought that the equity market, so dependent on incremental liquidity, could face challenges as the huge liquidity tide that boosted markets in 2020 started to slow down, but not necessarily start to recede.

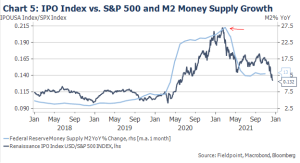

It has turned out that liquidity growth, as measured by M2 Money Supply Growth YoY, slowing from nearly 30% YoY to start the year to 13% today was not a problem for the broader market: the S&P 500 is up 23% YTD, meaning the 13% YoY growth in the money supply is still extraordinary.

However, slowing liquidity growth has been a problem for those areas of the market most dependent on or sensitive to liquidity.

Look at Chart 5. This shows the relative performance of the IPO Index vs. the S&P 500 (the dark blue line going up indicates recent IPO’s outperforming the market) and plots it next to the M2 Money Supply Growth YoY. Here we can see that the outperformance of risky, speculative IPOs tracked the huge surge of liquidity higher in 2020. But then IPO’s peaked versus the market coincidentally with the peak in liquidity growth.

The chart looks very similar if you substitute in the well-known speculative tech ETF.

This is a vitally important lesson: if the liquidity or macro environment is not supportive of an asset class, even an enchanting or powerful narrative will struggle to deliver relative performance.

This speculative weakness and underperformance has accelerated in recent weeks as the Fed has signaled a willingness to dial back support for markets and the economy, resulting in a tighter liquidity environment and likely slower growth. It likely also does not help that these areas are home to some of the most trader leverage, meaning the unwinds have been amplified by the closing out of leveraged positions.

So, trying to outperform by staying long the most speculative parts of the market as this tide of liquidity is ebbing could be like trying to surf Pipeline on a windy day in July: bound to end in disappointment.

Positioning for Tighter Liquidity

For months we have been talking about trimming the fat tails of portfolios, exiting the deepest value and most speculative growth to re-center to more quality equities.

We think quality becomes increasingly important as we move later cycle. The combination of slowing growth and tighter liquidity (the result of the Fed deciding to remove accommodation and then tighten conditions) typically favors quality names.

Investing in quality is likely to generate far lower returns than buying speculation during the heady days of the last two years’ liquidity boom, but as Brandon Flowers belts, “this is the world that we live in.”

The Growth Quandary

This desire for quality raises the thorny question of what to do with popular Growth stocks.

Many of these Growth names do check a lot of boxes on quality: stable idiosyncratic earnings growth, robust free cash flow generation, a strong balance sheet and substantial return of capital to shareholders.

But the challenge is that these names have also benefitted from the ample liquidity environment, characterized by ever falling real yields that have pushed the valuations on these names higher.

This strong earnings growth and multiple expansion (Growth now trades at 2x the valuation multiple as Value) has led to extraordinary outperformance of Growth vs. Value (Chart 6).

So, will relatively expensive Growth darlings be immune to a tighter liquidity environment thanks to their superior earnings growth and cash generation?

The lesson from the underperformance of the Nifty Fifty in the 1970’s and the underperformance of tech bubble survivors in the early 2000’s is that superior earnings growth is not enough to offset multiple compression when the liquidity and positioning tide turns.

A few weeks ago, we pointed out a potential risk for 2022 was actually lower inflation. If inflation starts to slow down on a YoY basis next year, even if nominal yields stay constant, real yields would rise (REAL YIELDS = NOMINAL YIELDS – INFLATION).

If Growth stocks have benefitted from falling real yields since late 2018 (the Powell Pivot) how will they perform in a scenario of potentially rising real yields?

The last time real yields rose from -1% to -0.58% in early 2021, Growth materially underperformed Value (1Q21 returns: Growth +0.75% and Value +10.7%). But after 1Q, real yields started to fall again, Growth reasserted its dominance, and is now besting Value for the year (YTD returns: Growth +22.4% and Value +18.9%).

2021’s performance would argue that Growth is not immune to the path of real rates, and thus our conclusion for 2022’s positioning between Growth and Value is to be more balanced.

If you have become way overweight Growth simply because of stellar Growth outperformance, the elevated valuations and sensitivity to potentially rising real yields could argue for rebalancing to include more Value oriented assets (we will discuss the many definitions of Value and where our preference for exposure lies in coming pieces).

The path of real yields and liquidity is like the tide, wind, weather and season for surfing. You can do all the right preparation for both activities. You can forecast earnings growth perfectly or buy the best surf board in the world, but if you don’t take into account these factors, which are outside of your control, your chances of success are far lower.

If only there was a market like the proverbial “perfect wave” at Cape St. Francis in South Africa, immortalized by Endless Summer, and so consistently perfect that the local fisherman found it rather boring. If only….

IMPORTANT LEGAL INFORMATION

This material is for informational purposes only and is not intended to be an offer or solicitation to purchase or sell any security or to employ a specific investment strategy. It is intended solely for the information of those to whom it is distributed by Fieldpoint Private. No part of this material may be reproduced or retransmitted in any manner without prior written permission of Fieldpoint Private. Fieldpoint Private does not represent, warrant or guarantee that this material is accurate, complete or suitable for any purpose and it should not be used as the sole basis for investment decisions. The information used in preparing these materials may have been obtained from public sources. Fieldpoint Private assumes no responsibility for independent verification of such information and has relied on such information being complete and accurate in all material respects. Fieldpoint Private assumes no obligation to update or otherwise revise these materials. This material does not contain all of the information that a prospective investor may wish to consider and is not to be relied upon or used in substitution for the exercise of independent judgment. To the extent such information includes estimates and forecasts of future financial performance it may have been obtained from public or third-party sources. We have assumed that such estimates and forecasts have been reasonably prepared on bases reflecting the best currently available estimates and judgments of such sources or represent reasonable estimates. Any pricing or valuation of securities or other assets contained in this material is as of the date provided, as prices fluctuate on a daily basis. Past performance is not a guarantee of future results. Fieldpoint Private does not provide legal or tax advice. Nothing contained herein should be construed as tax, accounting or legal advice. Prior to investing you should consult your accounting, tax, and legal advisors to understand the implications of such an investment.

Fieldpoint Private Securities, LLC is a wholly-owned subsidiary of Fieldpoint Private Bank & Trust (the “Bank”). Wealth management, securities brokerage and investment advisory services offered by Fieldpoint Private Securities, LLC and/or any non-deposit investment products that ultimately may be acquired as a result of the Bank’s investment advisory services:

Such services are not deposits or other obligations of the Bank:

− Are not insured or guaranteed by the FDIC, any agency of the US or the Bank

− Are not a condition to the provision or term of any banking service or activity

− May be purchased from any agent or company and the member’s choice will not affect current or future credit decisions, and

− Involve investment risk, including possible loss of principal or loss of value.

© 2021 Fieldpoint Private

Banking Services: Fieldpoint Private Bank & Trust. Member FDIC.

Registered Investment Advisor: Fieldpoint Private Securities, LLC is an SEC Registered Investment Advisor and Broker Dealer. Member FINRA, MSRB and SIPC.