The Crossing Point

Updated 2/1/2024

A normalizing yield curve could put bank deposit rates back on top. But will banks heed the call?

The Federal Open Market Committee’s (FOMC) historic run of 11 rate hikes since 2022 shook the Fed out of its most recent era of “zero interest rate policy” (ZIRP) and pushed the Fed Funds Rate (FFR) from 0.25% in March, 2022 to 5.50% in July, 2023, where it remains today.

The spike was of course intended to tame inflation by dragging economic growth expectations, even to the point of recession if history is an indication. As will happen in such situations, these reduced expectations in turn pushed the short-duration end of the bond yield curve upward and the long end downward, an inversion of the normal state where the longer you agree to hold a bond the more you will be paid.

With these spikes, short-term yields in money market funds – particularly government and especially Treasury – surged above bank interest rates, which for many reasons tend to move more slowly on average. With the Fed tightening, market players saw the writing on the wall and elected to stockpile a record amount of uninvested cash – eventually reaching $5.9 trillion in money market funds alone, according to the Investment Company Institute.

As money market fund rates surged, cash gushed from U.S. banks. Between the start of rate hikes in early 2022 and the banking crisis of March last year, $1 trillion left banks while money market fund balances increased by $1.3 trillion1. $300 billion departed in the last three weeks of March 20232 alone, contributing to three of the four largest bank failures in U.S. history3.

Scenarios for Normalization

A period of Fed policy stasis and then easing will be a key ingredient – if not the key ingredient — in the normalization of the curve. The question is timing, and therefore when will bank interest rates begin to exceed money market fund rates, at least among aggressive yield-oriented banks.

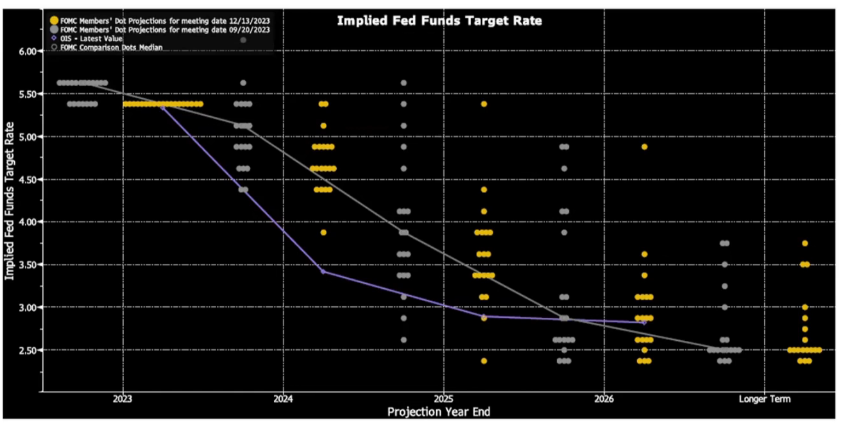

On December 13, Fed Chairman Powell’s press conference signaled dovishness on further FFR increases, stating “We are getting what we wanted to get” (growth, but at a slowing rate). The Fed kept rates steady for third consecutive meeting, in the 5.25-5.50% range.

Few expected a cut to be announced in the January meeting. Chairman Powell sprung no surprises. He allowed that he did not need to see the economy weakened in order to judge inflation tamed, but emphasized that inflation-reduction targets remain over the horizon. “The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent,” read the Fed’s statement.

“Higher for longer” remains the widespread rate expectation.

The Fieldpoint View

We believe that the flattening phase will begin in the first half of this year, and expect it is already underway.

With this, the short end of the curve will drop. Sideline cash held in professionally advised investment accounts, now typically parked in government securities money markets or managed Treasury investments, will begin to move, opportunistically, to bank sweeps as rates among certain banks will become advantageous, provided sufficient FDIC insurance is in place. To that point, Fieldpoint Private’s custodial deposit sweep, Fieldpass™, is insured to $100 million (joint account) or $50 million (single holder).

In the immediate term, however, the greatest opportunity yet-unrealized yield rests with cash held away from investment accounts – whether for lifestyle or long-term savings – at banks. While we all see aggressive rates marketed here and there, often with teasers and restrictions attached, in truth Americans continue to earn almost zero on this cash. There is a significant role for advisors in helping clients identify these earning opportunities.

In fact, according to the latest FDIC figures, the average yield on money market accounts is just 0.64% (or 1.39% when adjusted for banks’ market shares). For wealthy clients, bank cash – not including investment sideline cash – could represent 5% or more of their net worth.

There is a meaningful role for advisors in helping clients close this yield gap, and the exceptions to these stingy rates are notable, Fieldpoint among them. For instance, through our partner independent advisory firms we are offering a 4.6% annual percentage yield (APY)* on new savings for accounts above $250,000, with no account maintenance fees, and no expense ratios as charged by money market funds, along with FDIC insurance to $50 million or more. The same rate is available for commercial money market accounts, and we offering 2.53% APY on commercial operating accounts.

If you are a successful individual, family or business operator, we urge you to invite your financial advisor to review your bank statements and explore your options for optimizing rate, while maintaining the insurance and money-movement flexibility you require.

*Bank rates shown are Annual Percentage Yield (APY), subject to change.

1. Bloomberg

2. TS Lombard

3. See my article, What Just Happened, April 2023