Advanced Charitable Gifting Strategies (Doing Well by Doing Good!)

Introduction

In charitable gifting, while doing good should always be the prime directive, a well-known adage is to “do well by doing good”! Traditional gifts of cash or property directly to qualified charitable organizations benefit the charity and also the donor by creating income tax deductions for them.1 Gifts can also be made to public and private foundations and Donor Advised Funds (DAFs). This paper will focus on strategies that, while benefiting charity, do so in ways that create benefits for the donor as well. Primarily it will focus on split-interest trusts and, in particular, NIMCRUTs and FLIPCRUTs.

Charitable Remainder Unitrust (CRUT), a Quick Overview

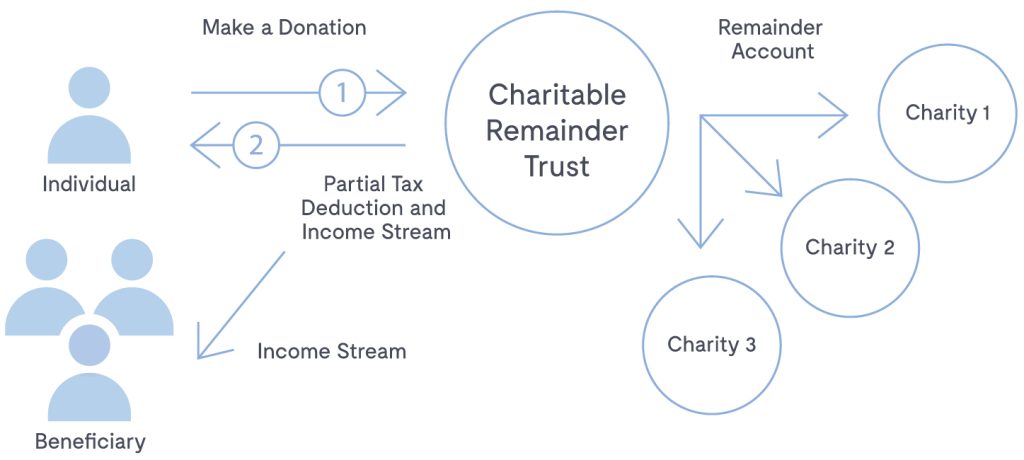

A standard CRUT is a planning strategy that allows a donor, often with an appreciated concentrated position in low-basis assets, to diversify out of those assets while deferring capital gain taxation. At the same time, it generates income for the donor, and potentially leaves a meaningful gift to charity.

It is an irrevocable trust created for a period of time, either single or joint lives, or for a fixed term up to 20 years. At the date of the contribution to the trust the donor becomes entitled to a charitable income tax deduction equal to the present value of the gift to be received in the future.2 (These are called “remainder” trusts because the charity doesn’t receive the gift until after the life of the trust.)

Once appreciated assets are sold (although in the case of illiquid assets they need not be), the proceeds can then be reinvested gross of tax. No tax is immediately payable because the trust is a charitable entity. This is good news for future returns.

From the year of creation until the trust terminates, the person creating it (or anyone else named) is entitled to an annual distribution from the trust.3 That distribution is a percentage of the value of the trust’s assets chosen when it is created and must be between 5% and 50%. It also must provide a 10% minimum actuarially determined remainder amount to the charity at the trust’s termination. Whether that remainder is 10% or higher is up to the grantor and will affect them in certain ways. In general, the higher the distribution percentage, the lower the amount ultimately available to charity and therefore the level of the income tax deduction. Conversely, the lower the percent of annual distribution, the higher the income tax deduction and amount potentially available to charity.4

Net Income with Makeup Charitable Remainder Unitrust (NIMCRUT)

A NIMCRUT is a variation on the theme of a CRUT. It does everything a CRUT does, but with twist! Whereas on one hand a CRUT works as described above, it does so in a somewhat mechanistic way. For example, the annual distribution is a fixed percentage of the asset level of the trust in any particular year and is on autopilot for the life of the trust. Moreover, that distribution must be made regardless of what the fluctuating needs of the beneficiary might actually be.

A NIMCRUT operates differently. While, like a CRUT, there is an annual income recipient and a charitable remainder beneficiary, there are important additional flexibilities. This variety of a split-interest trust allows the trust5 to make an annual distribution to the non-charitable beneficiary of the lesser of a) the fixed percentage stated in the trust, or b) the actual net income of the trust for that year. It further allows it, in later years, to make up any shortfalls between annual net income and the fixed unitrust percentage in years when excesses might occur – which is where the name of this type of trust comes from.

More specifically, each year the “trust’s” annual net income must be determined6 and if less than the unitrust percentage, it must be distributed. When that occurs, a make-up amount is determined, which is the difference between the fixed percentage amount and actual amount distributed. That and any similar subsequent amounts become “cumulative make-up amounts.” Then going forward, when in any year net income is greater than the fixed percentage, that greater amount can be paid out up to the available cumulative make-up ceiling.

For Example:

Assume a NIMCRUT with a 5% unitrust percentage that is funded with $1M of marketable securities. That would require a $50k annual distribution.7 If in the first two years net income was $10k/yr there would have been an annual shortfall of $40k ($50-10 = $40) and over the two years a cumulative make-up amount of $80k. If then, in year three, there was $100k of net income the trust would be able to pay out the entire amount…$50k as the percentage distribution + $50k of make-up. And there would still be $30k remaining in the make-up account ($80-$50=$30).

Upping the Game

So now, to dial things up, assume the NIMCRUT is funded with a 99% interest in an LLC, with the grantor retaining a 1% interest. The LLC could hold shares of a closely held family business, intellectual property, real estate, etc. The assets in the LLC could be sold and the proceeds reinvested or they could continue to be held in kind. The magic here is that there is no income to the trust until the management of the LLC makes a cash distribution to it.8 With that comes a very attractive ability to modulate the flow of income to the trust’s non-charitable beneficiary. Income can be deferred when advantageous and received when wanted or needed.

For Example:

Elio Mosynary owns several successful companies structured as LLCs and is at the point in his life when he would like to give back. As the CEO of these companies he has more than adequate income now, but at some point, would like to step back and eventually sell the businesses.

His advisors have suggested a NIMCRUT strategy. They explained he could create a NIMCRUT for his life expectancy, or a term of years up to 20, contributing the LLC shares to it. At the end of the trust’s life, its remaining assets would be distributed to the charity, or charities, of his choice (he could change those charities at any time he so chose). During the life of the trust, he would receive meaningful annual cash distributions, but they could be structured so that in years when he didn’t need the income it would accumulate in the LLC held by the trust. In later years when he might need it, the LLC could release income to the trust allowing for larger distributions at that time.

And then they told him “…but that’s not all!”

In the year he made the contribution of his LLC interest to the trust, depending on how it

was structured, he could receive a charitable income tax deduction. And, at his death, these assets might not be subject to estate tax.

Elio identified this as “doing well by doing good” and signed up on the spot!

And Because It’s All About Options.

Another flavor of CRUT is the FLIP-CRUT. This type of split-interest trust is used by donors who, while in general like the NIMCRUT concept, do not want to be locked into it forever. Perhaps Elio’s NIMCRUT has now sold the business in the LLC at a large multiple of its original value. And while those proceeds have been re-invested in income-producing assets, it is also the case that he initially chose a 10% rather than a 5% unitrust percentage. Under these circumstances it could well turn out that the 10% unitrust percentage, on the now much higher asset level, would be larger than the income the trust could produce. In other words, Mr. Mosynary would be stuck with the net income provision limitation and a lower distribution than he would have enjoyed if he had simply created a standard CRUT to begin with.

For Example:

Assume the LLC interest, after applicable discounts, is valued at $10M but the assets

only earn $500k. In that case, while the 10% distribution would be $1M, the actual

available income would never reach that level.

A solution to this is the FLIP CRUT. It is a NIMCRUT that is converted to a standard CRUT upon a triggering event or date. Permissible events include: a specific date, the attainment of a certain age of the income beneficiary and the sale of “unmarketable assets.” Important caveats are the flip cannot be reversed, it is permanent, and if there are any remaining make-up payments at the time of the flip they are forfeited.

So, another good arrow in the quiver.

Conclusion

There is an impressively wide range of ways to make gifts to deserving charitable causes. Increasingly popular are strategies that not only result in significant gifts, but also offer non-charitable financial benefits to the donor…let’s call it smart giving!

- Subject, of course, to AGI limitations, cost basis vs. FMV valuation rules, etc.

- In practice, in the case of a standar CRUT that might run between 30-40% of the value.

- On a tiered-pool basis first as ordinary income, then long term capital gain, tax-free income (like Muni bonds), and finally principal.

- Note: in CRUTs created for a life or lives, the older the grantor, the lower the income distribution will compute to be because of the 10% remainder to charity requirement.

- See IRC Sec 664(d)(3).

- This generally means trust accounting income according to the Uniform Principal & Income Act (UPIA).

- Assuming for purposes of this example no growth of principal.

- UPIA Sec. 401(b).