Johnny Gibson, CFA®, Chief Investment Officer

Cameron Dawson, CFA®, Chief Market Strategist

See below for your Weekly Perspectives from the Fieldpoint CIO Office. Here are the contents so you can focus on what is most relevant to you:

Weekly Perspective: It’s Coming: Home (Prices)

(Now, I don’t like to repeat themes in short order, but after the cacophony-on-repeat this weekend following the decisive victory of England over Ukraine in the Euros, I was rightly inspired…)

For a country that has made self-deprecation a national art form, it should be no surprise that the de-facto anthem of English football is a chirpy sing-along about how the country hasn’t been able to produce a tournament win in 30 (now 55) years.

Maybe the Fed is a secret Anglophile because it is engaging in its own anthem of self-doubt and missed goals saying, “it’s transitory, it’s transitory” when the topic of inflation is discussed. The Fed seems to have little faith that its own 10+ “years of hurt” from not reaching its 2% inflation target will come to an end soon.

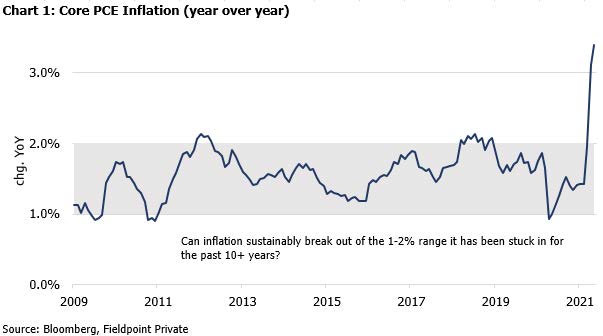

We don’t think that the inflation debate is a question of whether or not inflation will stay at its current elevated level of nearly 4% YoY (as measured by the Core PCE, the Fed’s preferred metric).

It is clear that the one-time impacts from the shocks of shut-down and reopening (such as used car prices, hotels, airfare, etc.) will dissipate in the coming months. Further, the base effect tailwind of easy comparisons from 2020 becomes a headwind of tough comparisons next year when comparing to 2021.

Instead of “4% forever?”, we think the question should be if the stickier drivers of inflation have the potential to lift inflation sustainably out of the 1-2% range that it has been stuck in for the past 10+ years up to the 2-3% range that could stir Fed action (see Chart 1).

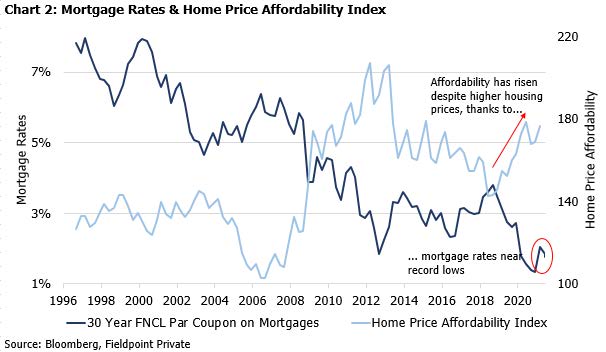

This is where home prices come in. The U.S. housing market has been on a tear, as U.S. home buyers have fled crowded cities to find refuge in the socially-distanced suburbs. Helped by record-low mortgage rates that boosted affordability (see Chart 2), home buyers quickly bid up prices for homes that were in relatively short supply (a remnant of the bursting of the 2000’s housing bubble).

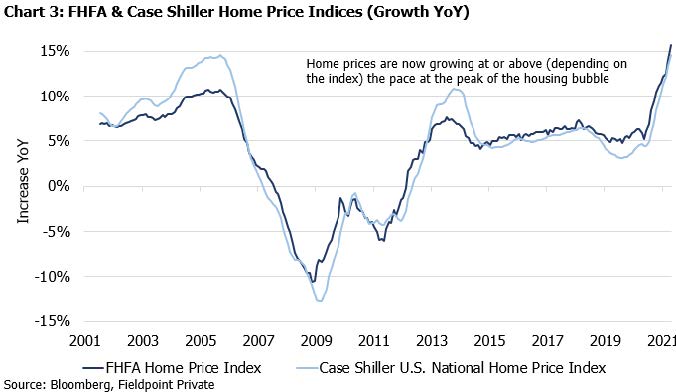

Following a short dip in the initial risk-off days of the pandemic, home prices have since sky-rocketed, rising at the fastest pace (and faster) since the 2005 peak of the housing bubble (see Chart 3).

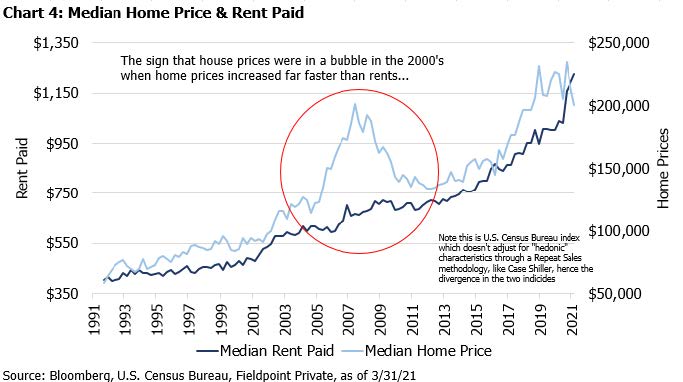

An aside, it is important to note that this rise in prices is not necessarily indicative of a 2000’s redux housing bubble (yet). Leverage remains under control, unlike in the 2000’s, while prices have not decoupled from rents in a significant way (see Chart 4). The rise in prices reflects a swift change in housing preferences that favored markets that had low supply. Of course, this doesn’t mean bubble-like conditions can’t emerge in the future, as the promise of quick profits often has the potential to spur speculative behavior.

Back to the implications of rising housing prices on inflation.

Housing is a large component in inflation measures. At over 40% of the CPI and over 30% of the PCE, the housing component has a far greater weighting than any of the reopening sensitive areas mentioned above (see Table 1).

Table 1: Components of Inflation Indices

Consumption category CPI-U (%) PCE-ADJ (%)

Food and beverages 15.1 17.0

Food at home 8.0 8.7

Food away from home 6.0 6.0

Alcoholic beverages 1.1 2.3

Housing 42.4 32.9

Rent 5.8 4.1

Owner’s equivalent rent 23.4 15.9

Other housing 13.1 12.9

Apparel 3.8 5.5

Medical care 6.2 5.0

Transportation 17.4 17.3

Motor vehicles 7.9 6.5

Gasoline 4.2 4.3

Other transportation 5.4 6.5

Education and communication 6.0 6.7

Recreation 5.6 8.4

Tobacco 0.7 1.2

Other goods and services 2.8 6.0

Total 100% 100%

Source: National Bureau of Economic Research

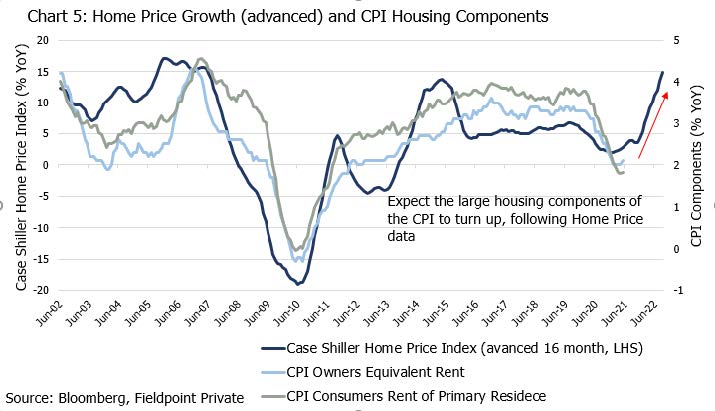

The housing components of inflation measures tend to lag the house price increases, as measured by indices like the Case Shiller Home Price Index, by about 5 quarters, or 16 months. Chart 5 shows this dynamic clearly.

This means that the sharp increase in home prices that began in June of 2020 will start making its way into inflation data soon and will likely be far stickier than the reopening components.

Of course, the Fed could write off the contribution of housing to higher inflation data as transitory as well. We noted above how the pandemic-induced shift in preferences is the main driver of housing price increases (with the addition of rapidly rising input costs due to supply chain disruptions). However, as this article by a Fed economist under Chair Arthur Burns in the 1970s shows, labeling each driver of inflation as idiosyncratic and not systemic has had dire consequences in the past.

But unlike the increase in used car prices, the Fed has had some hand in the rise of house prices by keeping mortgage rates low. The Fed continues to buy $40B/month of mortgage backed securities (along with $80B/month of Treasuries and a zero policy rate). This likely contributes to keeping mortgage rates near all-time lows. With mortgage rates low, home buyers can afford higher purchases prices as part of their monthly payment.

There is a growing chorus of market participants and policy makers questioning the merits of the Fed continuing to support an already healthy and increasingly expensive housing market. As home prices continue their rise, it will likely put pressure on the Fed to consider tapering the $40B/month of MBS purchases first.

Then, as house prices start contributing to inflation metrics, the calls for broader tapering will likely grow as well.

The bond market seems to agree that a nearer-term tapering is on the horizon. 10 Year Treasury yields continue to breakdown, down 40bps from their late-March high to 1.37% as of today. Somewhat counterintuitively, we have typically seen long bond yields decline during tapering cycles (not increase as some might expect given the lessened Fed buying activity). This is because tapering is perceived to bring forward further policy normalization, causing out year growth and inflation expectations to fall, along with creating greater demand for defensive assets.

To avoid a taper tantrum and even a deflationary shock, the Fed will have to work to convince the market that rate hikes and full policy “normalization” will not immediately follow the taper. This Economist article details this challenge.

Of course the Fed could resist these calls for tapering by continuing to focus on the need for “substantial further progress” in labor markets, as well as policy maker calls for improved housing inclusivity.

Without knowing the path of tapering or rate hikes, we can still draw one conclusion about monetary policy: the pace of monetary policy growth has already slowed materially. The Fed’s balance sheet is growing at 14% YoY today vs. 86% in mid-2020. M2 Money Supply is growing at 14% YoY today vs. 27% in February of 2021. We think this means less multiple expansion and higher volatility for equities, which could be amplified if tapering ensues.

So just as England may surprise itself with a European Football Championship Trophy this year, the Fed may surprise itself by achieving its inflation target. Both will likely end in a headache.

IMPORTANT LEGAL INFORMATION

This material is for informational purposes only and is not intended to be an offer or solicitation to purchase or sell any security or to employ a specific investment strategy. It is intended solely for the information of those to whom it is distributed by Fieldpoint Private. No part of this material may be reproduced or retransmitted in any manner without prior written permission of Fieldpoint Private. Fieldpoint Private does not represent, warrant or guarantee that this material is accurate, complete or suitable for any purpose and it should not be used as the sole basis for investment decisions. The information used in preparing these materials may have been obtained from public sources. Fieldpoint Private assumes no responsibility for independent verification of such information and has relied on such information being complete and accurate in all material respects. Fieldpoint Private assumes no obligation to update or otherwise revise these materials. This material does not purport to contain all of the information that a prospective investor may wish to consider and is not to be relied upon or used in substitution for the exercise of independent judgment. To the extent such information includes estimates and forecasts of future financial performance it may have been obtained from public or third-party sources. We have assumed that such estimates and forecasts have been reasonably prepared on bases reflecting the best currently available estimates and judgments of such sources or represent reasonable estimates. Any pricing or valuation of securities or other assets contained in this material is as of date provided as prices fluctuate on a daily basis. Past performance is not a guarantee of future results. Fieldpoint Private does not provide legal or tax advice. Nothing contained herein should be construed as tax, accounting or legal advice. Prior to investing you should consult your accounting, tax, and legal advisors to understand the implications of such an investment. You may disclose to any and all persons, without limitation of any kind, the tax treatment and tax structure of any transactions contemplated by these materials and all materials of any kind, (including opinions or other tax analyses), that are provided to you relating to such tax treatment and structure. For this purpose, the tax treatment of any transaction is the purported or claimed U.S. federal income tax treatment of the transaction and the tax structure of a transaction is any fact that may be relevant to understanding the purported or claimed U.S. federal income tax treatment of the transaction.

Are not FDIC Insured – Are Not Bank Guaranteed – May Lose Value

Wealth management, securities brokerage and investment advisory services offered by Fieldpoint Private Bank & Trust (the “Bank”) and/or any non-deposit investment products which ultimately may be acquired as a result of the Bank’s investment advisory services: Are not deposits or other obligations of the Bank:

⦁ Are not insured or guaranteed by the FDIC, any agency of the U.S. or the Bank;

⦁ Are not a condition to the provision or term of any banking service or activity;

⦁ May be purchased from any agent or company and the member’s choice will not affect current or future credit decisions; and involve investment risk, including possible loss of principal or loss of value.

© 2021 Fieldpoint Private

Banking Services: Fieldpoint Private Bank & Trust

Registered Investment Advisors: Fieldpoint Private Securities, LLC, is a SEC Registered Investment Advisor and Broker Dealer. Member FINRA, SIPC.