Whitepaper: Beginners Only – Estate Planning for People Who Have Not Yet Done Estate Planning

Many of you reading this have thoughtful and comprehensive estate plans in place, with all of the necessary supporting documents fully executed, subject to periodic review and updates. If that’s you, you can stop reading here. This article is for everyone else.

Intentionally defective grantor trust. Durable Power of Attorney. Testamentary. Intestate. Qualified personal residence trust. Credit shelter and qualified terminable interest property trust. And that’s all before you get to asset protection trusts…in the Cook Islands…Yikes!

No wonder it has been said that the various techniques and rules that comprise estate planning seem as expansive as the universe, and slightly harder to comprehend.

In truth, a better metaphor for estate planning is a simple bag of golf clubs (albeit one with convoluted names) – roughly a dozen tools, each of which is relatively easy to understand, with the flexibility to be deployed in a range of playing conditions.

Once you have a general understanding of these clubs and the shots you can make with them, you will know everything necessary to work constructively with an estate planning professional to protect your assets, your family’s bonds and your long-term ambitions for your legacy.

America’s Voluntary Tax

The first and most important principle I will share is this: while the estate tax may be law, it is not mandatory. Your family can pay it, or you can, to a meaningful degree, plan around it. Good estate planning takes out the sand traps and flattens the greens. Done properly, you can choose the score you want to shoot.

Enough with the metaphor. Let’s get started.

Why Estate Planning?

To be sure, estate planning takes into account many different objectives, from charitable inclinations to family communication and harmony, family business succession planning and more. But the primary purpose of estate planning is to protect your assets through generational transfer at your death (or the death of a surviving spouse).

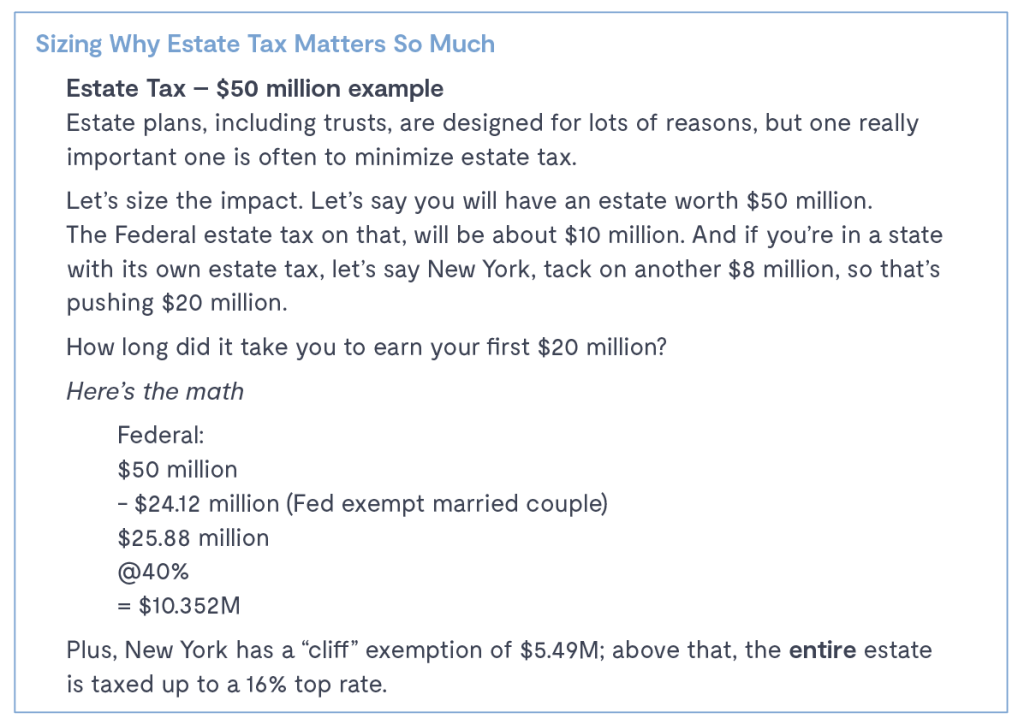

At the passing of the 2017 American Tax Cuts and Jobs Act, the estate tax exemption (the amount that could transfer to the next generation before estate tax kicks in) doubled, and now stands at $12.06 million ($24.12 million per couple), with a rate of 18-39% on the first $1 million, and 40% after that. Beyond this, many states have an estate tax of their own as well.

The Pieces in the Puzzle

We will highlight some of the available planning techniques (the golf clubs) in a moment, but first a few words on the basic elements of estate planning.

Distributing Your Assets

Until you get into the planning process you might assume that “who gets what” is determined by your Will. This is only partially true. Here is a more accurate picture of the determinants.

Asset Titling: Asset titling trumps any directives in a Will, Trust or other document. Here are a few that could cause issues:

Joint with Right of Survivorship – Assets become solely owned by the joint “tenant,” automatically, upon your death.

Tenants in Common – The joint tenant’s share must be directed via the Will in order to be transferred. The tenants don’t control one another’s shares.

Community Property/Marital Property – Some states, notably California and Texas, view property acquired during marriage as owned equally by both spouses, no matter who actually acquired it. On a state-by-state basis, this type of property can be owned “in common” or with right of survivorship.

Beneficiary Titling: Generally, financial accounts require you to designate beneficiaries who would take ownership on your death. These designations are typically required on 401(k) plans, IRAs, transfer on death (TOD) brokerage accounts, and insurance policies. The beneficiaries you name trump any other document that might stipulate otherwise, and the transfers bypass the probate process (as well as possibly your overall estate plan!).

The Will: The Will is a basic necessity. It names your executor (aka “personal representative”), guardianship of minor children and the recipients of assets held solely in your name (not owned jointly or transferring by beneficiary designation). If you are stipulating funeral arrangements, these also go in the Will.

If you die without a Will (dying “intestate”), any assets you have that are not directed by title or beneficiary designation will be distributed according to state law, which can be as full of unintended consequences as you would imagine. For instance, some states will split the estate 50/50 between your surviving spouse and children, even if granting a windfall to your 13 year old is the last thing you would want.

Your executor should, of course, be chosen with great care, and they are entitled to a fee, with a limit typically set by state statute. More detail on the duties of the executor can be found in our white paper, So Now You’re an Executor.

Supporting Documents

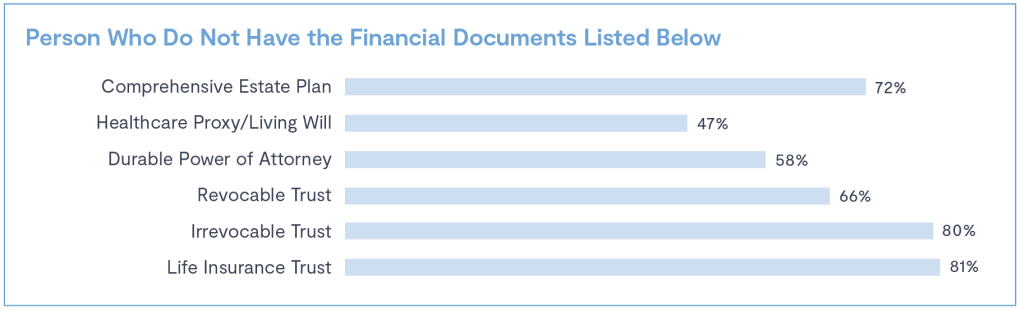

A proper estate plan includes, at minimum, three supporting documents that become operative if you become unable to make or communicate decisions:

Living Will: Also called a directive to physicians or advance directive, this lets people document their wishes for end-of-life medical care, in case they become unable to communicate their decisions. It has no power after death, so would carry no directives regarding as sets.

Heath Care Proxy: Designates a person to make health care decisions should you no longer be able.

Durable Power of Attorney: Designates a trusted individual with full legal power over your assets, to protect them during disability or incapacity.

Trusts

Trusts are legal agreements that, when properly constructed, allow you to minimize estate tax and ensure your wishes are carried out when you are no longer here. In each trust, you give control over assets to a second party to manage on behalf of a third party. In trust lingo, you are the grantor, your second party is the trustee and the third party is your beneficiary.

There are several layers that define the characteristics of trusts; this language is culpable for much of the head-scratching around trusts.

One layer defines when the trust takes effect. A trust is either effective at the time it is written (“living” trust) or at death (“testamentary”).

Another layer defines whether you can change or terminate the trust. If a trust is “living,” it can either be revocable (terminated and potentially revised as you wish) or irrevocable, meaning outside your control as soon as it is completed. With an irrevocable trust, the assets are transferred out of your name and into the name of the trustee, and under his control for management and distribution according to the specifications of the trust document. This moves them out of your estate (yes, you have an estate even while you are alive) for tax purposes, so irrevocable trusts carry the more powerful tax advantages. More on that in a bit.

If a trust is testamentary, it doesn’t take effect until you pass away, which means it is completely revocable while you are alive, but becomes irrevocable after your death.

Trusts are capable of wondrous things, and lawyers spend long careers coming to fully understand their capabilities, limitations and risks. So I will make no attempt to be comprehensive here. Let’s instead look at some of the most popular applications.

GRAT (Grantor-retained annuity trust): Reduces estate tax by freezing the size of your taxable estate. Shifts the growth on assets to heirs, while inoculating that growth from estate and gift tax.

CRUT (Charitable remainder unitrust): Converts a concentrated holding, like employer stock, into an income stream (at a favored tax rate), provides a charitable income tax deduction, and completely removes the asset from your estate.

IDGT (Intentionally defective grantor trust): Creates the ability to freeze the value of an asset in one’s estate via a sale that creates no immediate capital gains tax.

QPRT (Qualified personal residence trust): Allows a married couple to transfer the family home to children at a low gift tax value and also remove all future appreciation of it from their estate (it is a technique that is more effective in high interest rate environments).

ILIT (Irrevocable life insurance trust): Offsets the cost of estate taxes for your family via insurance proceeds that sit outside of your taxable estate.

Dynasty Trust: Enables the transfer of wealth over numerous generations, with no estate or other transfer taxes.

Asset Protection Trust: Protects assets from the claims of creditors or legal judgments.

Donor-Advised Fund: Private and efficient instrument for donating, investing and distributing charitable gifts.

The above list barely scratches the surface of what you can accomplish using trusts, individually and in combination. This is one of the most creative areas of American tax law, and when you combine a thoughtful contemplation of your goals with outstanding estate counsel, remarkable things become possible.

What is Estate Planning?

Estate planning is comprised of all of the above, and although its product is an estate plan, which sounds like a static, one-time thing, it must be anything but.

Instead, it is a process – a continuous lifetime process, regularly revisited for changing circumstances. New children. Changing spousal circumstances. Changes in your net worth and its makeup. And, of course, the continuous changes in estate tax law. A liquidity event at age 50 might look more like a real estate portfolio at age 60 – that requires a different estate plan. An adult child who develops a gambling problem, or another who develops triplets, or a growing interest on the part of your spouse in solving the puzzle of Parkinson’s Disease – these things all require changes in your estate plan. And once again, the continuum of pitfalls and opportunities created by the ongoing evolution of estate tax law.

In this way, your estate plan is not unlike the rest of your financial plan. When the environment changes, the plan changes.

I, along with your Fieldpoint Private Advisor, am pleased to consult with you on your estate plan. Think of us as complementary golf coaches, and remember, the estate tax is a voluntary tax, you can pay it, or plan around it.

IMPORTANT LEGAL INFORMATION

This material is for informational purposes only and is not intended to be an offer or solicitation to purchase or sell any security or to employ a specific investment strategy. It is intended solely for the information of those to whom it is distributed by Fieldpoint Private. No part of this material may be reproduced or retransmitted in any manner without prior written permission of Fieldpoint Private. Fieldpoint Private does not represent, warrant or guarantee that this material is accurate, complete or suitable for any purpose and it should not be used as the sole basis for investment decisions. The information used in preparing these materials may have been obtained from public sources. Fieldpoint Private assumes no responsibility for independent verification of such information and has relied on such information being complete and accurate in all material respects. Fieldpoint Private assumes no obligation to update or otherwise revise these materials. This material does not contain all of the information that a prospective investor may wish to consider and is not to be relied upon or used in substitution for the exercise of independent judgment. To the extent such information includes estimates and forecasts of future financial performance it may have been obtained from public or third-party sources. We have assumed that such estimates and forecasts have been reasonably prepared on bases reflecting the best currently available estimates and judgments of such sources or represent reasonable estimates. Any pricing or valuation of securities or other assets contained in this material is as of the date provided, as prices fluctuate on a daily basis. Past performance is not a guarantee of future results. Fieldpoint Private does not provide legal or tax advice. Nothing contained herein should be construed as tax, accounting or legal advice. Prior to investing you should consult your accounting, tax, and legal advisors to understand the implications of such an investment.

Fieldpoint Private Securities, LLC is a wholly-owned subsidiary of Fieldpoint Private Bank & Trust (the “Bank”). Wealth management, securities brokerage and investment advisory services offered by Fieldpoint Private Securities, LLC and/or any non-deposit investment products that ultimately may be acquired as a result of the Bank’s investment advisory services:

Such services are not deposits or other obligations of the Bank:

− Are not insured or guaranteed by the FDIC, any agency of the US or the Bank

− Are not a condition to the provision or term of any banking service or activity

− May be purchased from any agent or company and the member’s choice will not affect current or future credit decisions, and

− Involve investment risk, including possible loss of principal or loss of value.

© 2022 Fieldpoint Private

Banking Services: Fieldpoint Private Bank & Trust. Member FDIC.

Registered Investment Advisor: Fieldpoint Private Securities, LLC is an SEC Registered Investment Advisor and Broker Dealer. Member FINRA, MSRB and SIPC.