Johnny Gibson, CFA®, Chief Investment Officer

Cameron Dawson, CFA®, Chief Market Strategist

See below for your Weekly Perspectives from the Fieldpoint CIO Office. Here are the contents so you can focus on what is most relevant to you:

Weekly Perspective:

Nothing Compares 2 U: Thoughts on 2Q21 Earnings Season

Don’t worry, there is nothing as morose as a tight closeup of Sinead O’Connor in today’s update.

We are almost two-thirds of the way through earnings season (60% of S&P 500 companies have reported) and there are a few important takeaways.

First, earnings are coming in better than expectations. 88% of companies are beating Street estimates, with an average beat of 17%, using FactSet data. This is above the 5-year average for these measures of 75% and 7.8%, respectively.

This means that aggregate earnings are up 85% on a year-over-year basis, compared to estimates of 63% growth before the earnings season began.

Great news, right?

Well, reactions to earnings have actually been muted this quarter, with the S&P 500 only up 1% in the past month of reporting despite the 17% beat. The one-day price reaction on earnings days has been an average of +0.35% for the S&P 500 names.

In reality, earnings beats actually have a weaker correlation to forward equity returns than one might expect. According to Renaissance Macro, even when earnings beats are in the 95th percentile of strong readings, forward returns are only slightly above average.

This makes sense because the market is a forward discounting mechanism, meaning it sniffs out these beats long before the sell-side analysts have the gumption to ratchet up their estimates.

Sell-side analysts might also be behind the expectations of the actual owners of the stocks, lumped into the term buy-side analysts. These investors can often have higher expectations for earnings versus what is captured in the Wall Street consensus.

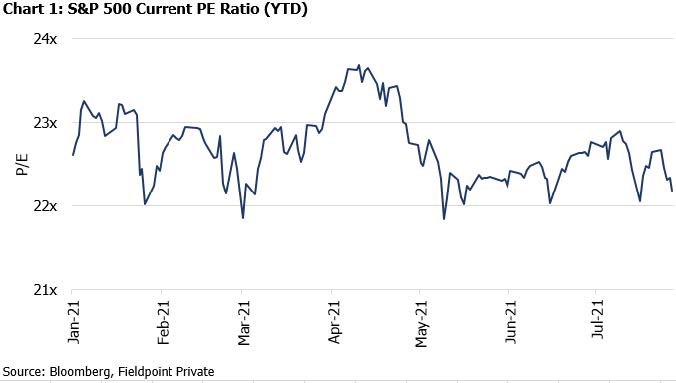

Also, if valuations are already high, as they were at 23.7x 2021 earnings at their YTD peak in April, big earnings beats provide an opportunity to “grow into” these elevated multiples. The current multiple on 2021 earnings for the S&P 500 has now fallen to 22.2x, offsetting some of the benefits from earnings growth (see Chart 1).

We do expect to see continued multiple compression as we move through the rest of 2021 and into 2022 for various reasons. These include a slowing tailwind and even an incremental headwind from monetary policy/liquidity growth, as well as peak data. This is why we often say that the combination of high valuations and peak data momentum creates a less supportive backdrop for near term forward returns. You can’t get better than best.

Similarly, the market is aware that this year’s big beats become next year’s tough comparisons.

We see that playing out in this quarter’s earnings for those companies that benefitted the most from 2020’s pandemic disruptions and lockdowns.

Companies in the e-commerce retailing, shipping, tech, and other lockdown beneficiary areas have been experiencing slowing growth rates as consumer spending patterns start to normalize. The reported growth rates can still be impressive, but the slowing momentum puts pressure on the multiples and likely limits near-term upside in the stocks.

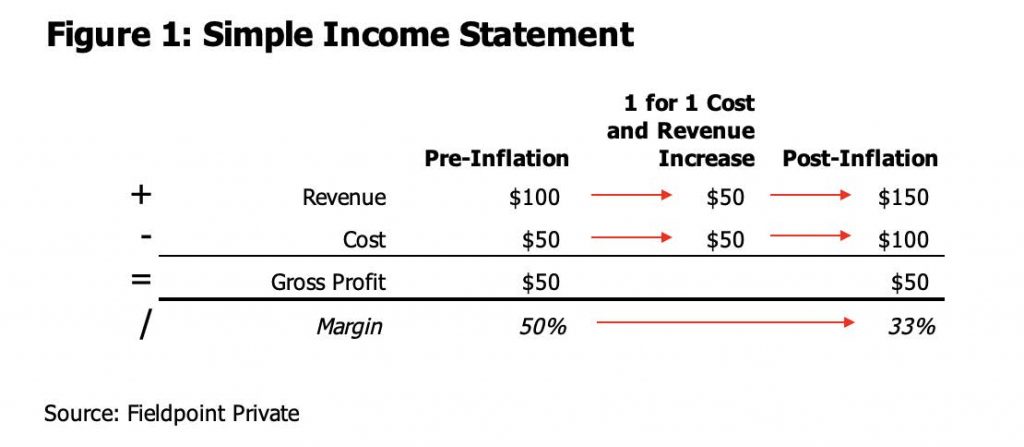

Another theme from this earnings season has been price/cost pressures and what it means for the optics of margins. This is worth a quick and simple accounting example to illustrate this dynamic, so bear with me.

Even if a company has perfect pricing power, meaning that it can immediately and fully offset a rise in costs with a matched increase in revenue from pricing, margins will decline.

Figure 1 shows this in a very simplified manner. A company that is able to fully offset an increase in cost with an increase in revenues will still see its margins fall.

You might shrug at this and say that the optics of percentage calculation should not matter, but the market does care.

An analysis done by Bloomberg’s Chief Equity Strategist, Gina Martin Adams, shows that companies that experience the biggest cuts to margin estimates trail those with the best margin performance by over 4% over a three-month period.

Note, the above scenario in Figure 1 is a great case scenario. Many companies do not have perfect pricing power, likely experiencing delays in passing on costs, as well as an inability to pass on the full cost increase. This FT article details this challenge for many manufacturing companies that produce consumer and industrial products.

This margin pressure helps to explain why companies can beat earnings expectations but experience weaker stocks. Margins matter for markets and maintaining those margins in a rising cost environment can be a challenge.

It is interesting to note that 1Q21 was an all-time high for margins in the S&P 500, as many companies were still enjoying the befits of internal cost cutting and revenue rebounds from 2020, while the input cost inflation had not quite started to hit yet.

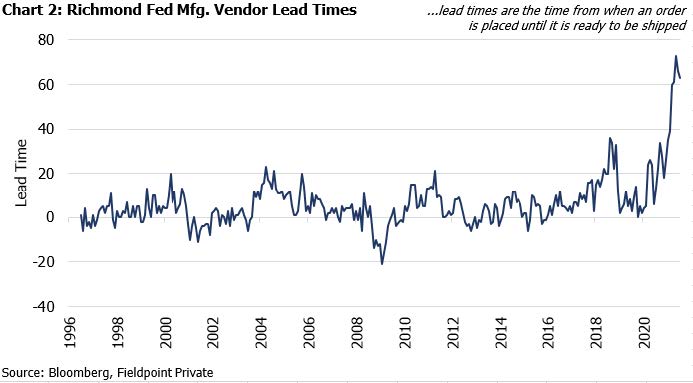

We do see this high cost environment persisting in the near term. Lead times in manufacturing have reached all-time highs, indicating tight supply chains (see Chart 2). Shipping costs remain elevated and shipping delays are widespread. Raw materials and components costs remain elevated.

Further, inventories are at record lows. Despite strong goods demand in the 2Q21 GDP report, inventories saw their largest drawdown since 2020 and 2009 (both periods of rapidly contracting demand). This means that producers simply have not been able to keep up with demand. Low inventories means strong pricing power for the seller but higher costs for the buyer.

The good news on inventories is that they will have to be replenished, providing a tailwind to goods production even if end demand moderates. Rarely do production cycles end when inventories are this low (they usually end when businesses already have too much of everything).

Overall, the big beats this earnings season have been positive for the fundamental backdrop of the market, but given the high valuations, high buyside expectations, tough comparisons, slowing momentum, and margin pressures, it is no surprise that the reaction to earnings has been muted.

IMPORTANT LEGAL INFORMATION

This material is for informational purposes only and is not intended to be an offer or solicitation to purchase or sell any security or to employ a specific investment strategy. It is intended solely for the information of those to whom it is distributed by Fieldpoint Private. No part of this material may be reproduced or retransmitted in any manner without prior written permission of Fieldpoint Private. Fieldpoint Private does not represent, warrant or guarantee that this material is accurate, complete or suitable for any purpose and it should not be used as the sole basis for investment decisions. The information used in preparing these materials may have been obtained from public sources. Fieldpoint Private assumes no responsibility for independent verification of such information and has relied on such information being complete and accurate in all material respects. Fieldpoint Private assumes no obligation to update or otherwise revise these materials. This material does not purport to contain all of the information that a prospective investor may wish to consider and is not to be relied upon or used in substitution for the exercise of independent judgment. To the extent such information includes estimates and forecasts of future financial performance it may have been obtained from public or third-party sources. We have assumed that such estimates and forecasts have been reasonably prepared on bases reflecting the best currently available estimates and judgments of such sources or represent reasonable estimates. Any pricing or valuation of securities or other assets contained in this material is as of date provided as prices fluctuate on a daily basis. Past performance is not a guarantee of future results. Fieldpoint Private does not provide legal or tax advice. Nothing contained herein should be construed as tax, accounting or legal advice. Prior to investing you should consult your accounting, tax, and legal advisors to understand the implications of such an investment. You may disclose to any and all persons, without limitation of any kind, the tax treatment and tax structure of any transactions contemplated by these materials and all materials of any kind, (including opinions or other tax analyses), that are provided to you relating to such tax treatment and structure. For this purpose, the tax treatment of any transaction is the purported or claimed U.S. federal income tax treatment of the transaction and the tax structure of a transaction is any fact that may be relevant to understanding the purported or claimed U.S. federal income tax treatment of the transaction.

Are not FDIC Insured – Are Not Bank Guaranteed – May Lose Value

Wealth management, securities brokerage and investment advisory services offered by Fieldpoint Private Bank & Trust (the “Bank”) and/or any non-deposit investment products which ultimately may be acquired as a result of the Bank’s investment advisory services: Are not deposits or other obligations of the Bank:

⦁ Are not insured or guaranteed by the FDIC, any agency of the U.S. or the Bank;

⦁ Are not a condition to the provision or term of any banking service or activity;

⦁ May be purchased from any agent or company and the member’s choice will not affect current or future credit decisions; and involve investment risk, including possible loss of principal or loss of value.

© 2021 Fieldpoint Private

Banking Services: Fieldpoint Private Bank & Trust

Registered Investment Advisors: Fieldpoint Private Securities, LLC, is a SEC Registered Investment Advisor and Broker Dealer. Member FINRA, SIPC.